Key takeaways:

- Keeping up with the quickly evolving ESG regulatory landscape will require cross-functional collaboration. ESG leaders shared their successes building steering committees with legal, operations, international teams, etc.

- It’s crucial to educate stakeholders on the state of ESG and sustainability regulations, but you’re more likely to gain traction when presenting this information through the eyes of the organization. Executives don’t care about news and trends; they care about how they’ll impact the business.

- Legislation is driving investments in staff and tools for better and faster reporting. Many ESG leaders are focused on improving data controls and ramping up assurance to meet these new standards.

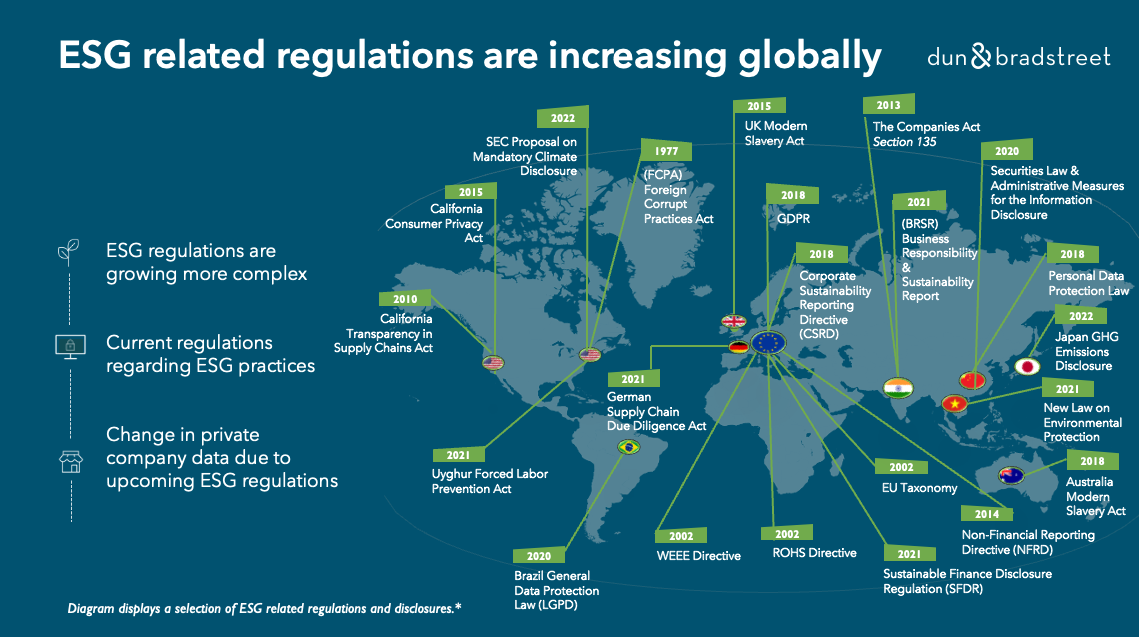

As global environmental, social, and governance (ESG) regulations gain momentum, organizations are facing surmounting pressure to ramp up their reporting capabilities.

Significant shifts are underway in the U.S. alone, exemplified by the recent enactment of California’s climate laws and impending SEC regulations mandating climate and ESG-related transparency from publicly traded companies.

Meanwhile, across the Atlantic, the European Union’s Corporate Sustainability Reporting Directive (CSRD) entered into force in early 2023, mandating large and listed companies to report on the environmental and social impact of their business activities.

Credit: Dun & Bradstreet

These regulatory developments signal a clear message: businesses must adapt their reporting and governance strategies to meet evolving ESG standards.

With data needs increasing and timelines feeling tighter than ever, the ESG & CSR Board hosted the heads of ESG at AbbVie, Smith+Nephew, and Leidos for a panel discussion on The State of ESG in 2024.

They shared best practices for tracking regulatory developments, cascading information to executives, and staying ahead of reporting requirements.

Employing Cross-Departmental Responsibilities to Meet Changing ESG Data Needs

Keeping on top of the huge wave of actual and potential ESG regulations is a tall order, particularly for global and regional teams needing to stay in alignment.

Daniel Pellegrom, Director of ESG and Corporate Responsibility at Leidos, acknowledged at the outset of the panel that most companies operating in a global landscape are still working to find the perfect solution.

What’s worked at Leidos is leveraging a cross-functional “Tiger Team,” Daniel said encompasses folks from operations, international business, legal, controllers, U.K. team members, and more. This team meets monthly, whether there’s something specific on the agenda or not.

“We’re working with the business units to figure out what applies to us and what doesn’t,” Daniel said. “We’re tracking that on a day-to-day basis, and I think we’re waiting with bated breath for some of the specifics from the SEC.”

Even if it’s determined that a piece of regulation won’t immediately apply to them, perhaps an EU law such as CSRD, Daniel said the U.S. team will continue to stay on top of the legislation in conjunction with their U.K. business partners — just because the requirements are not presently mandated doesn’t mean they won’t be in the future.

Not only does this frequent collaboration keep the teams in alignment, but Daniel shared that they’ve learned a lot from the U.K. team’s strategy, particularly in the area of science-based targets and regulations.

“We’re trying to make sure that we’re not just looking at where we are currently, but where the company is going,” Daniel said.

The other panelists shared similar models for tracking global disclosure requirements; Trent Riley, Director of ESG Reporting and Analytics at AbbVie, and Andrya Clark, Senior Director of Sustainability at Smith+Nephew, shared details of similar steering committees.

Many companies also look externally at third-party consultants or software solutions for tracking regulations; however, privately, some ESG & CSR Board members have acknowledged this is a costly path.

In our confidential community forum, one member leading ESG at a billion-dollar software company shared that their team contracted a lawyer to summarize ESG regulations they could be subject to.

Not only was this endeavor expensive, but it still required their team to perform considerable work afterward to determine if they met the thresholds for the identified laws. While the lawyer shed light on regulations the team wasn’t familiar with, none ended up being applicable.

“We’re trying to make sure that we’re not just looking at where we are currently, but where the company is going.”

Daniel Pellegrom, Director of ESG and Corporate Responsibility at Leidos

Engaging Your Board on the Evolving ESG Landscape

Time and attention from your company’s highest leadership is a precious commodity. It’s crucial that you’re maximizing your opportunities to engage and educate your Board on the ESG landscape and how it’s impacting business.

Panelists shared how they leverage their committees and other ESG-centric groups to drive awareness up to their executives, with Andrya calling their steering committee the first point of contact.

In addition to their steering committee, Trent said they leverage an ESG council, formed in 2021, to engage and drive support throughout the organization.

“That group is really engaged in our ESG work and provides a lot of support,” Trent said. “They regularly meet with their leaders, who are members of our executive team, to discuss their progress.”

“That group is really engaged in our ESG work and provides a lot of support. They regularly meet with their leaders, who are members of our executive team, to discuss their progress.”

Trent Riley, AbbVie

In terms of what concepts strike a chord with leadership, Daniel said they frame a lot of their work around mitigating business risks.

In the ESG & CSR Board’s forum, one member privately shared that after preparing several presentations for their Board, they learned that executives always prefer to see the ESG landscape through the company’s eyes. In other words, they don’t want to hear about recent news or trends but specifically how it will impact the company.

In the past, this member said they created a simple presentation listing ESG regulations that failed to truly land with leadership.

Moving forward, they created a deck showcasing a pyramid of the company’s ESG drivers, with the foundation being regulations and compliance and other stakeholder expectations and commitments layering on top.

This slide ended up being the focal point of the conversation and helped put leadership more in touch with their ESG initiatives and how they’re impacting the business.

In essence, educating top-level executives must go beyond just presenting regulatory information, but should delve deeper into how it will manifest within the organization, which can help you build trust and rapport in the boardroom.

Few people in your organization get this level of visibility — make sure you’re taking advantage of it.

Legislation is Driving Investments and Improvements in Data Collection and Assurance

Considering the variations in reporting standards globally, panelists touched on how they’re ensuring the accuracy and reliability of ESG data collected from diverse sources.

Trent provided a look into a process the ESG team developed with the internal audit team roughly two years ago to “tie off” on the KPI data disclosed in ESG reports.

The process encompasses various levels of review and approval and utilizes a third-party cloud-based software tool to capture and manage data, and an automatic process for gaining approval from VP-level leaders and above.

Both Trent and Andrya also mentioned plans to expand on their external data assurance, with Andrya sharing plans to include Scope 3 data next year.

Historically, Trent said they assured just a handful of environmental sustainability and workplace safety data points, but they’re expanding to include a majority of sustainability metrics in addition to business ethics and human capital metrics.

“I think that’s going to account for roughly 70% of the KPIs that we disclose through our ESG report,” Trent said.

He acknowledged that the team has a long way to go in preparation for CSRD, but this is an early step toward ensuring compliance.

Looking ahead, ESG & CSR Board members also have shared how legislation is driving investments in staff and tools for better and faster reporting.

Notably, stepping up data controls is a high priority for many members, with cross-functional teams being built across government affairs, finance, internal audit, and other key functions.

During the panel, Daniel mentioned that within a large organization, you have to remember that different parts of the company are in different phases of gathering information at different times.

As a result, he said the team is working to consolidate systems more effectively. With contract renewals coming up, they’re seeing if they can ideally reduce costs but also get on the same database.

Benefit From Expert Legal Advice and Peer Insights

As an ESG leader, executives expect you to be their in-house expert on all things sustainability, but the regulatory landscape is quickly evolving.

That’s why the ESG & CSR Board occasionally invites guest speakers to our confidential discussions — so members can learn from an expert legal mind about the regulatory scenarios they need to be thinking about.

It’s just one of the many ways members like Daniel, Trent, and Andrya get unbiased insights to help inform their strategies.