Key takeaways:

- After years of increasing enthusiasm, companies are feeling anti-ESG pressure, which is expected to continue.

- As an ESG leader, use this moment to sharpen your strategy and reinstate ESG’s connection with stakeholder value.

- ESG is not a perfect term and could evolve moving forward, but the work itself isn’t changing for ESG leaders.

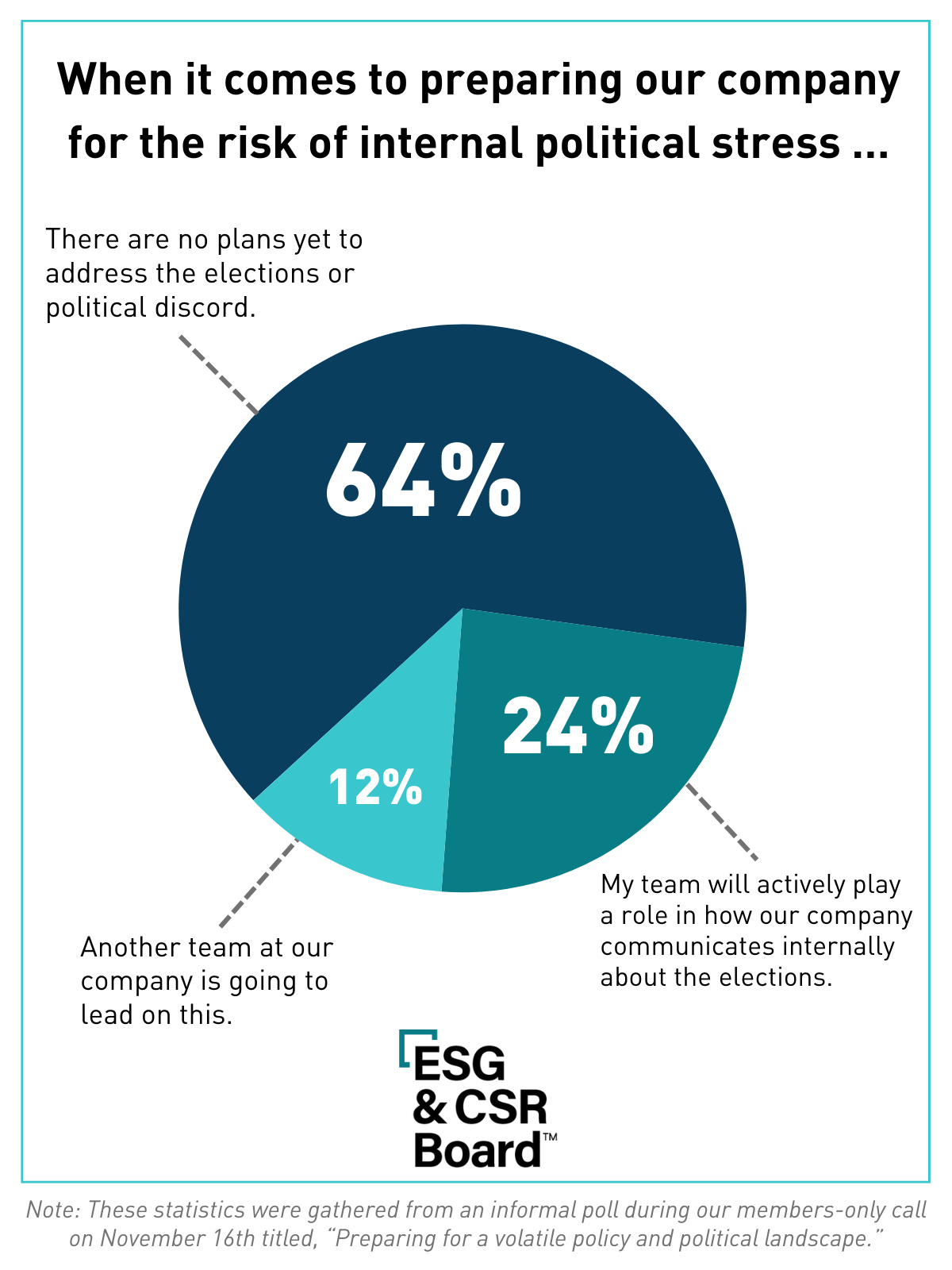

- When it comes to preparing for the 2024 elections, most ESG leaders aren’t taking the lead on internal communication or keeping political discord at bay.

Pushback against environmental, social, and governance (ESG) principles has moved from editorial pages to executives’ offices.

Companies are now facing considerable backlash as ESG becomes a hot-button political topic — and this scrutiny is expected to continue.

In a recent survey by The Conference Board of more than 100 large U.S. companies, nearly half said they have already experienced ESG backlash, and 61% expect it to persist or intensify in the next two years.

Those companies suggest federal and state officials and candidates as the leading source of backlash today. Now, we’re heading into a presidential election year in the U.S. in the midst of an already heated political context around ESG-related work.

As an ESG leader, how can you best navigate this volatile landscape to stay focused on the important work your team is doing?

ESG Work is Continuing Despite Increased Scrutiny

Though choppy political waters have made this corporate function more difficult, it’s clear that ESG leaders are not changing course.

Of the companies impacted by backlash in The Conference Board’s report, just 11% said they were changing the substance of their ESG programs.

During a recent ESG & CSR Board panel, The State of ESG in 2024, panelists echoed a similar sentiment.

Daniel Pellegrom, Director of ESG and Corporate Responsibility at Leidos, said while it’s upsetting to watch terms like ESG and DEI (Diversity, Equity, and Inclusion) become more controversial, ultimately, their work isn’t changing.

“We’re still focused on our goals, our community engagement, and the benefits of a diverse workforce,” Daniel said.

Trent Riley, Director of ESG Reporting and Analytics at AbbVie, agreed and said that, based on his experience, most companies feel similarly.

“Really, it’s not going to change our focus at all,” he said.

“We’re still focused on our goals, our community engagement, and the benefits of a diverse workforce.”

Daniel Pellegrom, Leidos

When it Comes to the Politics Around ESG, Listen to Your Stakeholders, Not the News

ESG & CSR Board members came together to discuss how they’re preparing for a volatile policy landscape in 2024.

They walked away with an acknowledgment that ESG is a global issue. Political headwinds in the U.S. should be considered, but they don’t represent the appetite worldwide.

In fact, during the ESG & CSR Board panel, Andrya Clark, Senior Director of Sustainability at Smith+Nephew, shared that as a U.K.-based company, ESG backlash has been less prevalent.

While you need to keep a pulse on the media, it’s more important that you’re listening to your stakeholders and proactively getting in front of the board to communicate your strategy.

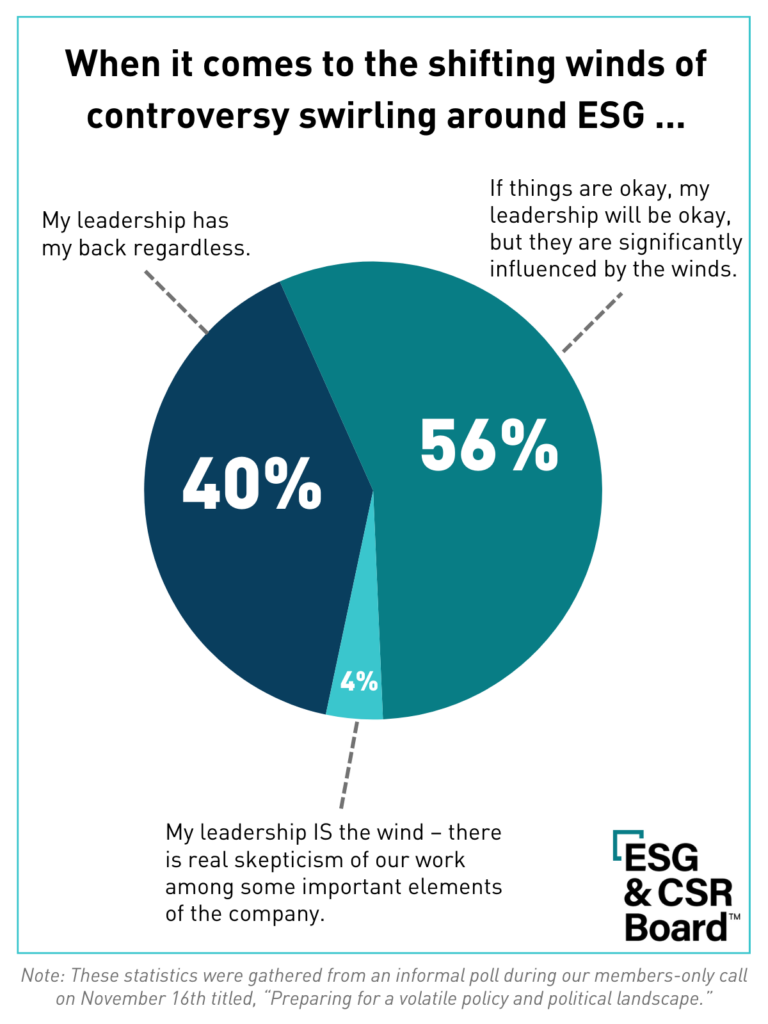

In an informal poll, a majority of members said their leadership is significantly influenced by the shifting winds of controversy around ESG.

Still, this skepticism doesn’t have to be discouraging. ESG backlash could serve as an opportunity to restate the business case for these initiatives, and sharpen your strategy overall.

In fact, 63% of company respondents in The Conference Board’s poll said they’re increasing their focus on how ESG impacts shareholder value.

ESG is Not a Perfect Term and Could Evolve Overtime

While it appears most U.S. companies aren’t backtracking on their ESG initiatives, they may be adjusting how they’re communicating them.

During the panel discussion, Daniel said they’re shifting their language toward corporate, social, responsibility, in part to avoid unnecessary attention or questions on the good work they’re doing.

“We’re aware and adjusting at some level, but we haven’t changed any of our efforts or work because it all goes back to what we believe is the right thing to do and good business,” Daniel said.

They’ve also used the term sustainability for their annual report, but Daniel reiterated that while they’re leaning into some terms more than others, the substance hasn’t changed.

Trent also reminded the panel audience that the ESG space is still green and undergoing substantial changes. When he first entered this space, it was most commonly referred to as corporate responsibility or environmental work.

“It probably will evolve over time. ESG is still a fairly new term,” Trent said. “Regardless of what it’s called, I think the underlying work stays the same.”

“ESG” might not be a perfect term, and some companies are already ditching the acronym.

About 20% of ESG & CSR Board members on a confidential call said they’ve either moved away from using the phrase ESG or may do so in the next year. Notably, those who have already done so reported having no regrets.

“It probably will evolve over time. ESG is still a fairly new term. Regardless of what it’s called, I think the underlying work stays the same.”

Trent Riley, AbbVie

Preparing Your Strategy Ahead of the 2024 Elections

The last time the U.S. had national elections, it meant radical disruption to ESG leaders’ work, with policy implications that continue to shape their strategies.

When ESG & CSR Board members confidentially met to discuss the upcoming elections, very few said they anticipated taking the lead on how to keep political discord at bay.

However, one member who will be at the forefront of this challenge for their organization said that their plan will be to try to proactively message civic engagement without taking sides and in doing so, prevent a conversation vacuum that could lead to the kind of heated debates they’d like to keep at bay.

They’re also considering how to handle the election aftermath, specifically how to create safe spaces for employees to express their feelings about the results.

During the panel discussion, panelists also talked about how much politics, particularly in the U.S., can shift companies’ agendas related to ESG.

“There’s not an easy answer,” Andrya said. “I think that’s really predicated on 50 states going 50 different directions in different timeframes, or even some going the same direction but in different timeframes.”

For example, Andrya brought up the newly enacted California climate bills and the recent replacement of Maine’s legislation halting natural gas expansions.

“It’s very difficult to keep up with everything and to ensure we’re doing it appropriately when you’ve got states moving at different rates,” she said.

Despite the patchwork of state bills, impending global legislation is forcing the maturation of ESG programs, especially regarding investments in data collection, reporting, and committee governance.

“There’s not an easy answer,. I think that’s really predicated on 50 states going 50 different directions in different timeframes, or even some going the same direction but in different timeframes.”

Andrya Clark, Smith+Nephew

Mitigating Burnout as an ESG Leader

It’s clear that this work is as challenging as it is rewarding. In light of this rapidly evolving field, panelists shared their words of advice and encouragement for their peers.

To stay ahead of these changes, Daniel said, “Try to anticipate as much as you can, even if you might end up anticipating a little incorrectly”

On a personal note, Andrya highlighted the importance of taking adequate time for yourself to avoid burnout and return to work recharged.

Trent also encouraged ESG leaders to find their own support system.

“Be willing to accept help and try to identify who those helps might be internally, and make sure that you establish strong relationships,” Trent said.