The argument has never been more clear for enterprises around the world to monitor — and ultimately reduce — greenhouse gas emissions.

In 2020, over 4,500 companies worldwide self-reported their GHG emissions to the public, and roughly 40% committed to specific emissions targets as part of their strategic financial plans, as reported by McKinsey & Company.

Before a company can make ambitious emissions reduction goals, it first needs to effectively manage GHG data collection, monitoring, and reporting.

But with so many moving pieces and factors to consider, where should you begin? Let’s dive into advice from three senior-level sustainability leaders managing GHG emissions at large companies.

1. Establishing baseline greenhouse gas emissions

The first step toward committing to emissions targets is establishing baseline GHG emissions.

This baseline will serve as a key reference point throughout your journey and will allow your enterprise to better understand and track its emissions over time, according to Serena Mau, a sustainability leader currently working in environment and supply chain innovation at Apple.

In an article for Sinai Technologies, a California-based company focused on carbon emission monitoring automation, Serena wrote, “Building a multi-year emissions baseline not only enables an organization to have a better understanding of its recent historical GHG emissions trends but it also enables an organization to grasp the business trajectory and associated potential future emissions.”

This was true for the multi-billion dollar biotechnology company, Illumina, according to Sharon Vidal, Senior Director of Corporate Social Responsibility and Sustainability.

During an ESG & CSR Board panel on taking climate action at the enterprise level, Sharon said the need to establish baseline GHG emissions sparked a large internal conversation.

Illumina set long-term climate goals but had already done considerable work in individual energy efficiency and emissions reductions. As a result, the team needed a good representation of the progress that had been made and the work ahead.

“If we’re going to set an absolute target, where is the right place to draw the line in the sand?”

Sharon Vidal, Senior Director of Corporate Social Responsibility and Sustainability at illumina

The first step involved getting facility-level energy data in one place & selecting a tool to manage all that data globally. Sharon shared that this in itself can feel like a huge win and will allow your company to really get a pulse on its Scope 1 and Scope 2 footprint, identify where reduction opportunities lie, and where to focus efforts.

A GHG reporting tool will enable your company to manage data in a more efficient way than traditional spreadsheets, which is where most of this work likely began. Selecting the right reporting tool can be an invaluable component of your reduction strategies.

2. Leveraging tools to manage GHG reporting

During the ESG & CSR Board panel, Kristina Friedman, Head of Global ESG Strategy at PayPal, echoed the importance of effective data management.

She said it’s paramount to gather GHG information in a clear and transparent way, particularly ahead of future national and global regulatory requirements. As a result, Kristina said she’s focused on building for the future and evaluating how GHG and other ESG information will be incorporated into legal and regulatory reporting.

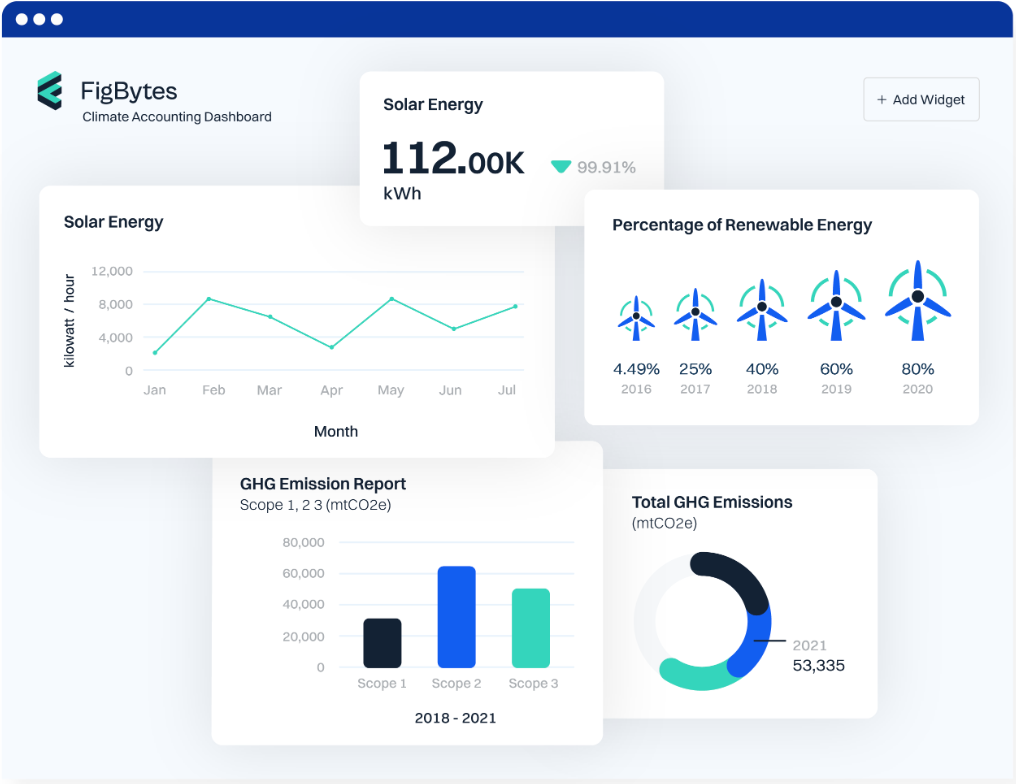

One of Kristina’s peers, Jami Haaning, Director of ESG at Lam Research, shared her vision for a new tool the company is rolling out — FigBytes, an ESG software platform.

Jami said her team is working towards moving to a broader ESG database that will allow them to capture data from across the company that can be integrated into annual reports. She is expecting it will enable more data-driven decision-making and could be a game changer in terms of visibility and process streamlining.

Historically, Jami explained how Lam Research has leveraged environmental data by looking back at the numbers and the team hasn’t had a great ability to manage the data on an ongoing basis.

“We want to put some more governance in place and some more expectations around regular reporting. We’ll be looking at that data and reporting it up to our executives and other stakeholders on a more regular basis,” Jami said.

Whether it’s Fig Bytes or the plethora of other environmental data tools, Sharon said there are exciting advancements in the ESG space that will enable easier reporting. Much like evaluating climate risk and opportunities, Sharon said there are so many new tools that have been rolled out in the past few years that can help your team better manage data.

3. Enabling enterprise-wide accountability

In order to successfully collect the myriad of GHG data, you need to empower a culture of accountability and collaboration across the enterprise.

At PayPal, this is, in part, accomplished through an Environmental Working Group, which is chaired by the Global Environmental Sustainability Lead. Kristina said the group brings together key business leaders for monthly — or as often as needed — meetings.

According to PayPal’s 2020 CDP Climate Change Report, the group operates as a cross-functional team responsible for managing PayPal’s environmental impacts and completing the annual review of environmental risks and opportunities.

Sharon agreed that this type of cross-team collaboration, particularly with supply chain leaders, is crucial to reaching climate-related goals. Similar to PayPal, the sustainability team at Illumina partners closely with facility managers and each site-level leader, who are all included in the annual third-party verification progress and meet regularly to review data.

“It goes to the philosophy that we have overall about how we approach CSR & ESG,” Sharon said. “The intent is not to build out an army of CSR professionals and just have that be a separate entity that’s working and ticking the boxes on some reporting elements. It’s really about embedding this into how we do business.”

4. Looking to future advancements and opportunities

The ESG and sustainability space is no stranger to advancements and evolutions, and the same can be said for how enterprises collect and monitor GHG emission data.

Kristina said PayPal first started its GHG inventory in 2017 and has seen considerable enhancements since.

During the panel discussion, Kristina told the audience, “I think that’s the key takeaway for companies listening today [and] thinking about embarking on this if they’re new to the journey, you have to start somewhere and it’s going to improve over time.”

Benchmarking strategies with other corporate ESG leaders can be a great way to improve upon your own strategies. Leaders like Kristina Friedman, Jami Haaning, and Sharon Vidal, make these connections in the ESG & CSR Board — the confidential community for senior social impact, sustainability, and ESG leaders.

Interested in learning more about the ESG & CSR Board?

Get in touch